In Hand Salary Calculator New Tax Regime

Simply enter your annual or monthly income into the tax calculator above to find out how taxes in Canada affect your income. However the concessional slab rates come at the cost of traditional income tax deductions that can be claimed under the old existing tax regime.

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

The salary calculator will show you the deductions such as the employer and employee provident fund professional tax employee insurance and the take-home salary.

In hand salary calculator new tax regime. Income Tax Calculator for FY 2021-2022. Meanwhile the highest tax bracket reaches 1075 on income over 5 million. If you have several debts in lots of different places credit cards car loans overdrafts etc you might be able to save money by.

Salary Before Tax your total earnings before any taxes have been deducted. Income from salary is the sum of Basic salary HRA Special Allowance Transport Allowance any other allowance. For instance an increase of 100 in your salary will be taxed 3491 hence your net pay will only increase by 6509.

Salary After Tax. Try out the take-home calculator choose the 202122 tax year and see how it affects your take-home pay. 025 L at 0 Rs 0 2550 L at 5 Rs 12500 5075 L at 10 Rs 25000 7510 L at 15 Rs 37500 100110 L at 20 Rs 2000.

Scope of Take Home Salary Calculator India Excel In-Hand Salary Calculator India This calculator works if you have the following elements in your CTC. Simply enter your annual or monthly income into the salary calculator above to find out how taxes in Ireland affect your income. The deductions could vary from each company and are based on your CTC Cost to Company.

This marginal tax rate means that your immediate additional income will be taxed at this rate. PayHR Income tax calculator is an simple online tax calculator tool that helps you to estimate your tax based on your income. In the above tax calculator if you enter your salary and add the investments you add it will automatically suggest the best tax option for you.

This tax calculator will show comparison of both tax regime. To know more about Income tax saving guidelines click here. Depending on which tax regime you opt for your tax will be calculated accordingly.

If you dont qualify for this tax credit you can turn this off under the IETC settings. New tax regime and Old tax regime. Also known as Gross Income.

Some components of your salary are exempt from tax such as telephone bills reimbursement leave travel allowance. Income tax calculation for the Salaried. Your average tax rate is 221 and your marginal tax rate is 349.

It is the total salary an employee gets after all the necessary deductions. The Central Board of Direct Taxes Chairman PC Mody says that the new tax regime offers lower slabs without exemptions. The new income tax calculations were announced with the new budget on 1 st February by FM Sitharaman.

In-Hand salary means Take home pay in India. According to the new budget individual taxpayers can switch back and forth between the new tax regime and the old structure. Take Home Pay Gross.

The salary calculator consists of a formula box where you enter the Cost To Company CTC and the bonus included in the CTC. The Salary Calculator has been updated with the latest tax rates which take effect from April 2021. Tax as per new regime no exemption no deduction Tax Payable.

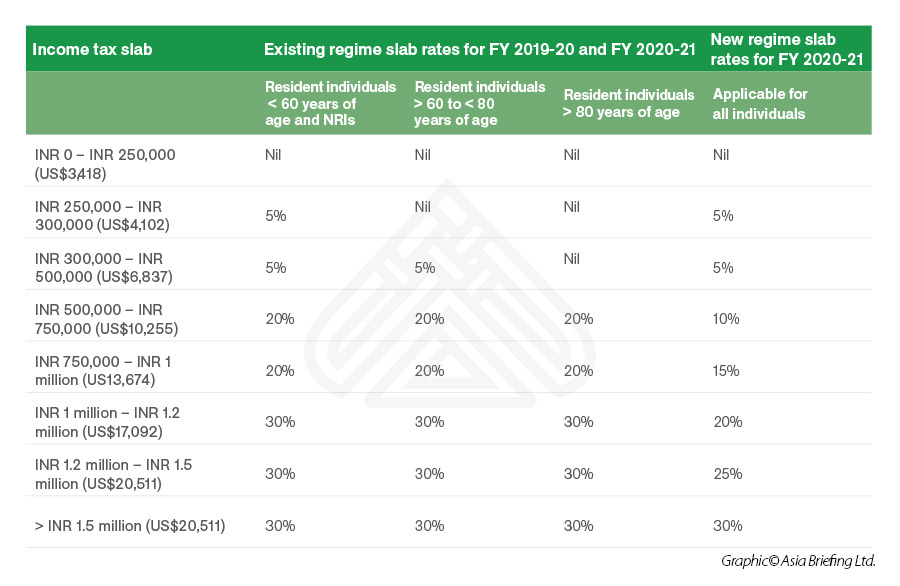

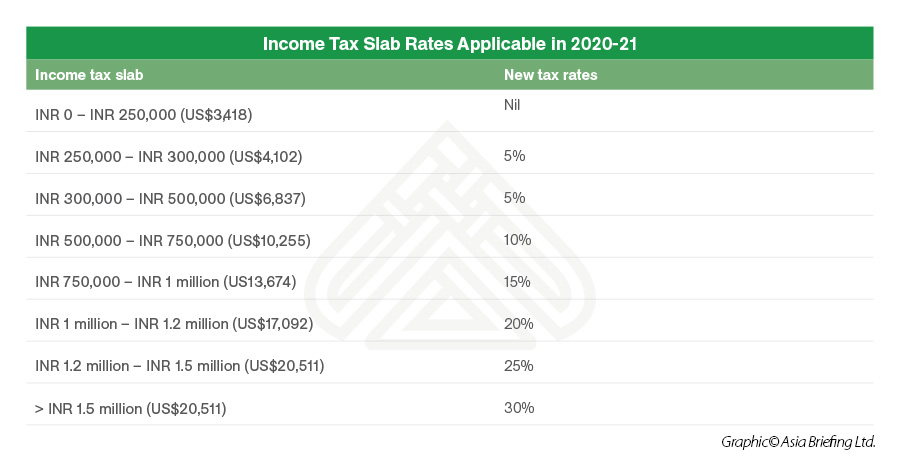

Under this new regime the income tax slab rates have been significantly reduced. But wait heres the catch although the table might look pleasing but to avail the new tax regime you will have to forego all your tax exemptions and deductions which you have been claiming to decrease your overall tax liability. House Rent Allowance 3.

Take Home Pay Week. This reduces the amount of PAYE you pay. You have 2 options for tax filings ie.

Download Income Tax Calculator in Excel for FY 2020-21 AY 2021-22 Comparison Old and New Regime. Provident Fund Employers Contribution 4. Salary After Tax.

In-hand is a word used in daily life to mean the final amount received after the deduction of taxes. Also known as Gross Income. Youll then get a breakdown of your total tax liability and take-home pay.

Now according to the new tax regime Taxes Paid. At the lower end you will pay at a rate of 140 on the first 20000 of your taxable income. It also changes your tax code.

An income tax calculator is a tool that will help calculate taxes one is liable to pay under the old and new tax regimes. If you are single or married and filing separately in New Jersey there are seven tax brackets that apply to you. Income Tax Saving Guidelines for Employees.

Effective FY 2020-21. Salary Before Tax your total earnings before any taxes have been deducted. Youll then get a breakdown of your total tax liability and take-home pay.

A new and optional income tax regime was announced in Union Budget 2020. Basic Salary Include Dearness Allowance if any 2. The calculator uses necessary basic information like annual salary rent paid tuition fees interest on childs education loan and any other savings to calculate the tax liability of an individual.

In-Hand Salary Monthly Gross Income Income tax Employee PF Other deductions if any.

Income Tax Calculator New Optional Slabs Announced In Budget Calculate Your Tax For Next Yr

Income Tax Calculator Calculate Your Income Tax Online In India

Irs Tax Forms Form 1040 Schedule C Schedule E And K 1 For Business Irs Tax Forms Irs Taxes Tax Forms

Pin By Corporate Shadow Business Co On Taxation Services Convenience Store

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

Budget 2018 Income Tax Slabs For Fy 2018 19 Income Tax Income Income Tax Statement

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

Income Tax Slab 2020 21 Old Tax Regime Or New One Which Is More Beneficial The Financial Express

Income Tax Calculation Fy 2020 21 Old Vs New Income Tax Slabs Which One Is Beneficial For You

What Is Tds Tax Deducted At Source How To Pay Tds Online Tax Deducted At Source Life Insurance Companies Wealth Planning

Pin By Gilberteclemencechristabellz On Mortgage Online Mortgage Budgeting Calculator

Australian Writer American Publisher W 8ben Tax Form State Tax Tax Forms Irs Forms

Download 10 Gst Invoice Templates In Excel Exceldatapro Invoice Format Invoice Template Excel

Income Tax Slabs Tax Rates Calculation For 2021 22 Old Vs New Youtube

The Good Wife New Budget Worksheet Safe Deposit Box Log Budgeting Worksheets Good Wife Budgeting

What Is Annual Income How To Calculate Your Salary Salary Calculator Income Income Tax Return

Post a Comment for "In Hand Salary Calculator New Tax Regime"