Gross Salary Calculator Online

Taxable Income Income Gross Salary other income Deductions. SalaryWage and taxes in Latvia.

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

If you dont qualify for this tax credit you can turn this off under the IETC settings.

Gross salary calculator online. How much money will be left after paying taxes and social contributions which are obligatory for an employee working in Germany. The latest PAYG rates are available from the ATO website in weekly fortnightly and monthly tax tables. Calculating in-handtake home salary.

Our gross net wage calculator helps to calculate the net wage based on the Wage Tax System of Germany. 292 rader Calculate net pay based on gross salary income and the municipality you live in. The calculator covers the new tax rates 2021.

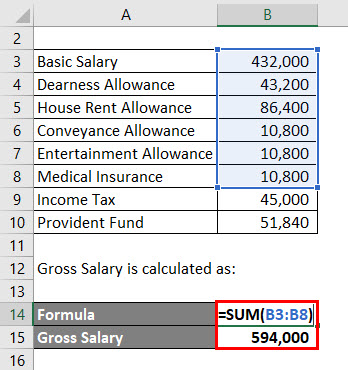

The pension contribution is 12 of the pensionable wages made up of two equal portions of 6 from the employee and 6 from the employer subject to an upper limit of KSh 2160 for employees earning above KSh. Enter the yearly gross salary and percentage of basic salary HRA dearness allowanceDA conveyance allowance medical allowance special allowance professional tax and bonus the net salary calculator tool will automatically fetch you the detailed salary breakup and net salary amounts. Our online salary tax calculator is in line with changes announced in the 20212022 Budget Speech.

Take Home Pay Week. Take Home Pay Gross. Why not find your dream salary too.

In other words employees wishing to have a specific net salary in a year can use this tool to calculate how high the gross salary would have to be to yield the desired net amount. TaxTim will help you. Calculate income tax Step 4.

These are the steps that help you to know how to calculate your take-home salary. The calculation is based on the Tax Agencys own tables. Upon retirement both NSSF and pension contributions are based on an individuals gross income the Upper earning limit of KSh 18000 while the Lower earning limit of KSh 6000.

Enter Your Salary and the Indonesia Salary Calculator will automatically produce a salary after tax illustration for you simple. Enter the net wage per week or per month and you will see the gross wage per week per month and per annum appear. Please note where a net salary has been agreed the employer will be covering the employees pension contribution in addition to.

TDS is calculated on Basic Allowances Deductions 12 IT Declarations Standard deduction Standard deduction 50000. This calculator now conforms to the Australian Tax Offices Pay As You Go PAYG schedules. Select Advanced and enter your age to alter age related tax allowances and deductions for your earning in Egypt.

Please make use of our SARS income tax calculator and work backwards to get to the number you require Submit your tax return right here. Simply enter your current monthly salary and allowances to view what your tax saving or liability will be in the tax year. This calculator is used by businessHR managers as well as accountants responsible.

The ClearTax Salary Calculator will show you the performance bonus and the total gross pay. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. Its so easy to use.

Gross Salary CTC EPF Gratuity Step 2. SalaryWage and Tax Calculator - Estonia Latvia This website may use cookies or similar technologies to personalize ads interest-based advertising to provide social media features and to analyze our traffic. FY 2019 2020 Income Tax formula for FY 2019 2020 Basic Allowances Deductions 12 IT Declarations Standard deduction Deductions are the sum of PF ESI and PT etc.

In addition to calculating what the net amount resulting from a gross amount is our grossnet calculator can also calculate the gross wage that would yield a specific net amount. The latest budget information from April 2021 is used to show you exactly what you need to know. Select Advanced and enter your age to alter age related tax allowances and deductions for your earning in Indonesia.

Hourly rates weekly pay and bonuses are also catered for. Calculate salary after taxes. Calculate how tax changes will affect your pocket.

The gross-pay calculator uses the latests PAYE NHIF NSSF values to calculate the gross-pay and present it in a simple payslip as it could look in in a typical payroll. It also changes your tax code. Enter Your Salary and the Egypt Salary Calculator will automatically produce a salary after tax illustration for you simple.

Use the calculator to work out an approximate gross wage from what your employee wants to take home. It will also display the professional tax employer PF employee PF Employee insurance and the take-home salary. Annual Gross Pay Annual Take Home Pay Effective Tax Rate.

Salary Formula Calculate Salary Calculator Excel Template

How To Calculate Net Salary Gross Salary In Excel Youtube

Salary Calculator Statistics Explained

What Is Gross Salary How To Calculate Gross Salary

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

Basic Salary Calculation Formula In Excel Download Excel Sheet

Salary Formula Calculate Salary Calculator Excel Template

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

Paycheck Calculator Take Home Pay Calculator

How To Calculate My Monthly Salary In India If I Know My Ctc And The Split Ups Quora

How To Calculate Salary Increase Percentage In Excel Free Template

Salary Formula Calculate Salary Calculator Excel Template

Salary Breakup Calculator Excel 2021 Salary Structure Calculator

Salary Formula Calculate Salary Calculator Excel Template

Salary Calculator Statistics Explained

7th Pay Commission Salary Calculator 2021 7th Cpc Pay Scale Calculator 2021 Central Government Employees News

Paycheck Calculator Take Home Pay Calculator

12 Best Salary Calculators And Online Payroll Calculators

Post a Comment for "Gross Salary Calculator Online"