Take Home Salary Calculator London

It can also be used to help fill steps 3 and 4 of a W-4 form. UK Take Home Pay Calculator.

Corporate Tax Calculator Template Excel Templates Excel Templates Business Tax Business Structure

Also known as Gross Income.

Take home salary calculator london. Income tax calculator. The 20142015 net salary tax. The latest budget information.

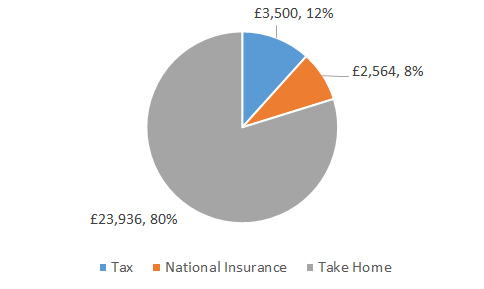

Youll then get a breakdown of your total tax liability and take-home pay. You must have a legal reason for processing the information used in the calculator and have consent from the employee to. Your gross hourly rate will be 2163 if youre working 40 hours per week.

Use this calculator to find exactly what you take home from any salary you provide. These include income tax as well as National Insurance payments. The Salary Calculator has been updated with the latest tax rates for the 2021 tax year.

Youll pay 6500 in tax 4260 in National Insurance and your yearly take-home will be 34240. This calculator is intended for use by US. If you have a pension which is deducted automatically enter the percentage rate at which this is deducted and choose the type of pension into which you are contributing.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Find out your take-home pay - MSE. To get started enter the first salary into the first field and the second into the second field.

872 if over 25 820 21-24 years old 645 18-20 years old 455 for under 18 years old and 415 for apprentice. The 20202021 UK minimum wage National Living Wage per hour is currently. 45000 Salary Calculations example If your salary is 45000 a year youll take home 2853 every month.

To get started choose one of the options below. You can use our calculator to produce statements detailing total savings pension contributions and take home pay at employee level. The UKs income tax and National Insurance rates for the.

By default the calculator selects the current tax year but you can change this to a previous tax year if desired. To find out your take home pay enter your gross wage into the calculator. The wage can be annual monthly weekly daily or hourly - just be sure to configure the calculator with the relevant frequency.

Easy-to-use salary calculator for computing your net income in the United Kingdom. Why not find your dream salary too. Please see the table below for a more detailed break-down.

Simply enter your annual or monthly income into the salary calculator above to find out how taxes in Ireland affect your income. If you are a member of the Swedish Church - The church fee varies between 1-15 of your salary. Salary Before Tax your total earnings before any taxes have been deducted.

How to use the take home pay calculator. The 20152016 net salary tax calculator page. If you know your tax code enter it into the tax code box for a more accurate take-home pay calculation.

We have redesigned this tool to be as easy to use as possible whilst maintaining the level of accuracy you expect from our selection of tax tools. The 20162017 net salary tax calculator page. How to calculate the net salary.

A person working in London typically earns around 86400 GBP per year. To see how the new rates and thresholds will affect your take-home pay choose the year 2021 from the Tax Year drop-down box. The 20202021 UK Real Living Wage is currently 1075 in London and 930 elsewhere.

If you are unsure of your tax code just leave it blank and the default code will be applied. Your gross salary - Its the salary you have before tax. Find out the benefit of that overtime.

Salaries range from 21900 GBP lowest average to 386000 GBP highest average actual maximum salary is higher. Calculate your take-home pay given income tax rates national insurance tax-free. Take home pay calculator london.

This is the average yearly salary including housing transport and other benefits. Enter the number of hours and the rate at which you will get paid. The latest budget information from April 2021 is used to show you exactly what you need to know.

Moving to another country is not a decision that should be taken hastily. For example for 5 hours a month at time and a half enter 5 15. Hourly rates weekly pay and bonuses are also catered for.

Where you live - The municipal tax differs between the municipalities. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. In order to calculate the salary after tax we need to know a few things.

Salary after Tax is an easy-to-use online calculator for computing your monthly or yearly net take-home salary based on the fiscal regulations for 2021. Use our advanced UK income tax calculator to calculate your net salary and exactly how much tax and national insurance you should pay to HMRC based on. Salaries vary drastically between different careers.

Our simple salary calculator gives an estimate of your take-home pay after your employer has made deductions from your gross salary. Calculate your annual and monthly take home pay from a contract outside IR35. How to use the Take-Home Calculator To use the tax calculator enter your annual salary or the one you would like in the salary box above If you are earning a bonus payment one month enter the value of the bonus into the bonus box for a side-by-side comparison of a normal month and a bonus month.

How To Calculate The Net Salary From Gross In Portugal Lisbob Salary Portugal Calculator

Take Home Pay Calculator Find Your Pay With Dns Accountants Http Www Dnsassociates Co Uk Take Home Pay Calculator F Umbrella Insurance Accounting Umbrella

Income Taxes Preparing A U S Tax Form With Money In Mind Spon Preparing Taxes Income Tax Mind Ad Income Tax Income Tax Forms

International Salary Calculator Calculate The Salary You Will Need

8 Tax Tips For Freelancers In Germany Invoice Template Tax Germany

Salary And Tax Deductions Calculator The Accountancy Partnership

How Accountants Help Businesses To Grow And Achieve Their Financial Goals Tax Services Income Tax Accounting

The Salary Calculator Income Tax Calculator Salary Calculator Income Tax Income

Chiltern Firehouse London United Kingdom Hotel Review Photos Wupatki National Monument Moving To Scotland Glasgow

Pro Rata Salary Calculator Uk Tax Calculators

80 000 After Tax Us Breakdown July 2021 Incomeaftertax Com

The Salary Calculator Pro Rata Tax Calculator

Comparison Of Uk And Usa Take Home The Salary Calculator

Tax Calculator And Pen Calculating Numbers For Income Tax Return With Pen And C Aff Pen Calcu Accounting Notes Income Tax Return Stock Photography Free

Flat Design Vs Skeuomorphism Flat Design Design Web Design

Hmrc Tax Refund Revenue Online Services

50 000 After Tax 2021 Income Tax Uk

Post a Comment for "Take Home Salary Calculator London"