Gross Net Income Calculator Canada

Calculate salary after taxes. The calculator is updated with the tax rates of all Canadian provinces and territories.

How Do You Get From Net Income For Tax Purposes To Taxable Income To Tax Payable Intermediate Canadian Tax

Formula for calculating net salary.

Gross net income calculator canada. Rates are up to date as of June 22 2021. It is perfect for small business especially those new to doing payroll. Enter the number of hours worked a week.

Each salary calculator provides detailed tax and payroll deductins to allow visability of how salaries are calculated in each province in Canada in 2021 based on the personal income tax rates and thresholds for 2021. Its used to determine your federal and provincial or territorial non-refundable credits or any social benefits you receive like the GSTHST credit or the Canada child benefit. The amount can be hourly daily weekly monthly or even annual earnings.

ADP Canada Canadian Payroll Calculator. New Brunswick Salary Calculator. Your net income is calculated by subtracting all allowable deductions from your total income for the year.

This is required information only if you selected the hourly salary option. C 29527 22410 20109. Find tech jobs in Canada.

Get started for free. Net Income Taxable Income - Canadian Tax - Nova Scotia Tax - CPP - EI For self-employed workers The same calculation must be made for the self-employed worker. Select your yearly income range.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. Input your gross salary per month and get an estimate of your net income as well as how much social insurance and Individual Income Tax IIT is payable in your region in China. If you are looking to compare salaries in different provinces or for different salary rates as part of a job search you may prefer the salary comparison calculator which allows you to compare upto 6 salaries side by side so you can see which salary provides the highest take home pay.

Calculate net pay based on gross salary income and the municipality you live in. Individual Income Tax IIT Calculator - China 2021. At the same time more leading roles like Software Architect Team Lead Tech Lead or Engineering.

The payroll calculator from ADP is easy-to-use and FREE. Net weekly income Hours of work week Net hourly wage. Use the Canada Tax Calculator by entering your salary or select advanced to produce a more detailed salary calculation.

The 1 household income in Canada earns 306710. Use this simple powerful tool whether your staff is paid salary or hourly and for every province or territory in Canada. Gross annual income Taxes Surtax CPP EI Net annual salary.

The 50 household income in Canada earns 44807. Enter your pay rate. The 75 household income in Canada earns 21811.

The basic personal tax amount CPPQPP QPIP and EI premiums and the Canada employment amount. The 5 household income in Canada earns 157486. The 10 household income in Canada earns 122274.

The annual net income is calculated by subtracting the amounts related to the tax Canada Tax and Ontario Tax the Ontario surtax the Canadian Pension Plan the Employment Insurance. C 2461 1868 1676. PaymentEvolution provides simple fast and free payroll calculator and payroll deductions online calculator for accountants and small businesses across Canada.

That means that your net pay will be 40568 per year or 3381 per month. The calculation is based on the Tax Agencys own tables. These calculations are approximate and include the following non-refundable tax credits.

British Columbia Salary Calculator. Gross annual income - Taxes - Surtax - CPP - EI Net annual salary. A minimum base salary for Software Developers DevOps QA and other tech professionals in Canada starts at C 85000 per year.

Net annual salary Weeks of work year Net weekly income. Please complete the following fields to calculate your net income and the amount of IIT due. Gross annual income Taxes CPP EI Net annual salary Net annual salary Weeks of work year Net weekly income Net weekly income Hours of work week Net hourly wage.

After-tax income is your total income net of federal tax provincial tax and payroll tax. This marginal tax rate means that your immediate additional income will be taxed at this rate. The 25 household income in Canada earns 78820.

Your average tax rate is 220 and your marginal tax rate is 353. Formula for calculating net salary in BC. Canadian Payroll Calculator by PaymentEvolution.

Net Salary Calculator Canada Salary Calculator Bad Credit Mortgage Online Mortgage

What Is Net Income H R Block Canada

How Do You Get From Net Income For Tax Purposes To Taxable Income To Tax Payable Intermediate Canadian Tax

29 Free Payroll Templates Payroll Template Payroll Checks Statement Template

Net Household Savings Rate In Selected Countries 2019 Saving Rates Savings Household

Pin On Mortgage Amortization Calculator

Rental Property Calculator 2021 Wowa Ca

Manitoba Tax Brackets 2020 Learn The Benefits And Credits

Find A Job Job Opening Job Posting

5 3 Explanation Interpretation Of Article V Under U S Law Canada U S Tax Treaty Rental Income Interpretation Real Estate Rentals

Canada Federal And Provincial Income Tax Calculator Wowa Ca

Gross Up Add Backs Explained How To Increase Income For A Mortgage

What Is The Net Salary In Hand For A Gross Salary Of Sek 50 000 After Employer Tax Paid In Stockholm Sweden Quora

Net Income Template Download Free Excel Template

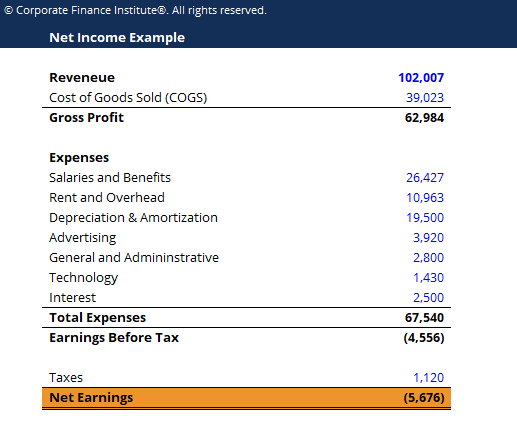

Net Income The Profit Of A Business After Deducting Expenses

Post a Comment for "Gross Net Income Calculator Canada"